Private or Alternative Loans

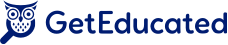

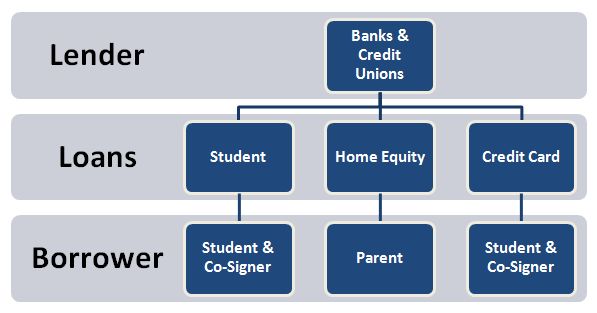

These are educational loans offered by private lenders, such as banks, credit unions and other financial institutions. There are usually no federal forms and eligibility is based on the borrower’s credit score, instead of financial need. Instead of being set by the government, different interest rates and fees are set by each individual private lender. In-state students can often find better rates at state loan agencies than other private lenders such as banks.

These loans are not federally guaranteed and so the interest rates and fees can change with time and tend to be higher than federally fixed rates. For this reason, federal loans tend to be cheaper. It’s best to exhaust federal resources first and then use private loans to help cover expenses not included in federal aid, such as a student’s expected family contribution or extra expenses from attending a more expensive school.

For student’s pursuing private loans, it’s usually best to have a co-signer and many private lenders require it. This is because most students do not have an established credit history and having a co-signer makes loans for the lender less risky. Since interest rates and fees will be determine based off the better credit score, having a co-signer is good way to get a lower rate and save money.

Co-signers are equally responsible for the loan and risk getting stuck with the payments since any delinquencies or defaults will affect both theirs and the borrower’s credit history. Unlike federal education loans, unpaid private loans will end up on the borrower’s credit report. Private lenders can also choose to take back any dispersed funds, causing students to lose their educational funding.

Home Equity Loans & Lines of Credit

For students hoping to supplement their savings, private loans are also a good way to by-pass the cost of attendance limitation attached to educational loans. Private lenders offer both educational loans and mixed-use loans. Mixed-use loans are not attached to restrictions of educational aid and will also not affect any other funding. These loans come at higher price however and students often end up paying back much more on a mixed-use loan than other educational loans.

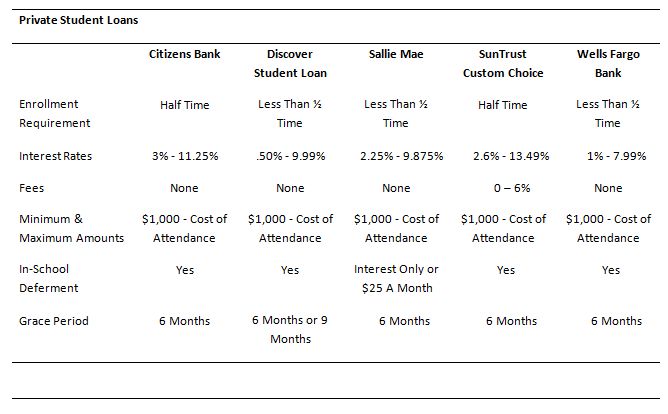

The most commonly used mixed-use loans home equity loans and credit cards. Direct Parent PLUS and home equity loans both have fixed rates that are usually in the same ballpark of each other. Home equity lines of credit and private education loans also have competitive variable rates. All of these loans, including the Direct Parent Plus, hold a parent responsible if students fail to pay. They all also have a similar repayment period of 10 years or more.

The most commonly used mixed-use loans home equity loans and credit cards. Direct Parent PLUS and home equity loans both have fixed rates that are usually in the same ballpark of each other. Home equity lines of credit and private education loans also have competitive variable rates. All of these loans, including the Direct Parent Plus, hold a parent responsible if students fail to pay. They all also have a similar repayment period of 10 years or more.

However, since mixed-use loans are not considered educational, they do not offer payment deferment while a student is in school or for economic hardship. They also carry a more serious risk. A student who defaults on educational loans may have their funding garnished or lose money from their social security. However, defaulting on a home equity loan or line of credit can cause borrower’s to lose their house.

Credit Score

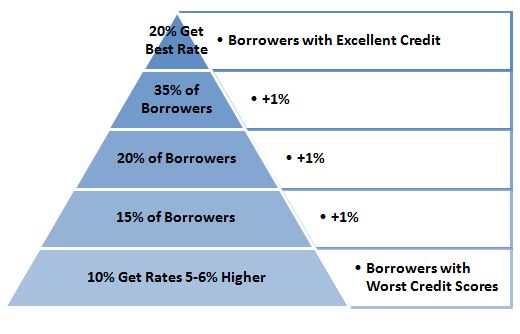

Any private loan requires a credit history complete with an acceptable credit score. Private lenders use this score to determine interest rates and loan fees. Most lenders require a score of 650 of higher to be eligible for a loan. This score is based on the Fair Isaac Corporation scale. With the higher score rated best, the scale ranges from 300 to 850.

Any private loan requires a credit history complete with an acceptable credit score. Private lenders use this score to determine interest rates and loan fees. Most lenders require a score of 650 of higher to be eligible for a loan. This score is based on the Fair Isaac Corporation scale. With the higher score rated best, the scale ranges from 300 to 850.

These numbers are used to measure the likelihood that a person will pay their agreed debt. Individuals with higher scores are considered a lower risk to lenders and offered better interest rates and fees, whereas individuals with lower scores are viewed as more likely to default on a loan. Credit scores are determined by an individual’s payment history, amounts owed, length of credit history, new credit and types of credit used.