January: The Free Application for Federal Student Aid

The Free Application for Federal Student Aid (FAFSA) is used by students applying for federal, state and school administered financial aid. It simplifies the process, making it easier for students to apply for and view all of their available options. The FAFSA becomes available January first of each year and may be submitted any time before the end of June. However, filling out and submitting the FAFSA as soon as possible is the best way to ensure students will receive their total amount of potential aid. Some federal aid programs are awarded on a first come, first serve basis and some schools have student aid deadlines as early as February.

The Free Application for Federal Student Aid (FAFSA) is used by students applying for federal, state and school administered financial aid. It simplifies the process, making it easier for students to apply for and view all of their available options. The FAFSA becomes available January first of each year and may be submitted any time before the end of June. However, filling out and submitting the FAFSA as soon as possible is the best way to ensure students will receive their total amount of potential aid. Some federal aid programs are awarded on a first come, first serve basis and some schools have student aid deadlines as early as February.

Federal Student Aid PIN

This is a four-digit number combination that operates just like a virtual autograph. It is used, not only as an identification tool, but as a signature for sensitive material. This little number is how student loan contracts are made. It is also used to virtually sign Master of Promissory Notes.

The first place most students run into this little number is at the end of their FAFSA. On the very last page, when ready to “Sign & Submit,” students are prompted to apply for their Federal Student Aid PIN. It takes one to three business days for PINs to be verified once requested. Until verified, student PINs are considered conditional and can only be used to virtually sign a FAFSA.

Federal Student Aid PINs are different from the online passwords created when beginning a FAFSA application. These passwords exist only to allow application to be filled out in segments. They save changes and save students the trouble of having to start over with each stop or interruption. However, once a FAFSA has been submitted, it is a student’s PIN that allows them to review the document and make any appropriate changes.

Application Information

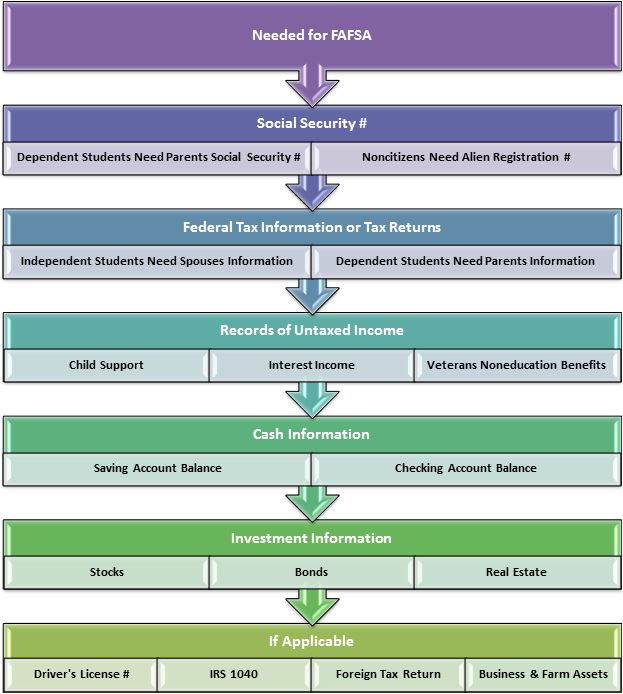

The FAFSA operates as a government formula that gathers information about a student’s financial situation and then it compares to their cost of attendance. This formula evaluates a student’s financial neediness, which is calculated by subtracting their expected family contribution from their cost of attendance. To evaluate a student’s expected family contribution, the FAFSA requires information from certain financial documents.

The FAFSA operates as a government formula that gathers information about a student’s financial situation and then it compares to their cost of attendance. This formula evaluates a student’s financial neediness, which is calculated by subtracting their expected family contribution from their cost of attendance. To evaluate a student’s expected family contribution, the FAFSA requires information from certain financial documents.

The FAFSA also requires that at least one institution of higher education be listed as a possibility for attendance. However, the online application allows for up to 10 entries, which should be ordered according to first choice followed by consecutive choices.

February: Student Aid Report

A Student Aid Report (SAR) is a summary of the results calculated by a student’s FAFSA. After filing an application, a student’s report should arrive within six weeks. The report will present a student’s calculated EFC to be reviewed, edited for mistakes and then resubmitted. Once sent back with any corrections, a new SAR will be sent out. This time, both the student and schools listed will receive copies.

March & April: Award Package

Schools receive electronic versions of a student’s aid report. From which, a student’s financial need will be measured against the cost of attending their institution. Once a student’s financial need has been determined, schools will put together and mail an award package to applicable students. This award package will describe in detail the types and amounts of federal, state and school aid a student is eligible for. Award packages should begin arriving as early as March.

When award packages start arriving, students are given a clearer picture of where they stand financially. They can also calculate any out-of-pocket expenses that remain unaccounted for and judge whether or not to apply for other forms of aid.

May: Private Education Loans

May is usually when award packages have been decided on and accepted. They are signed and sent in with a copy of a student’s aid report. May is also when students should start applying for any additional aid needed. Private lenders, such as banks and credit unions, offer education loans that can be used along with federal education loans. Students often use private loans to fill in any gaps unaccounted for in their school award package.